Housing Underproduction

This week Up for Growth published 2023 Housing Underproduction™ in the U.S. The organization’s web page does a great job of highlighting national drivers, trends, and history of US housing underproduction.

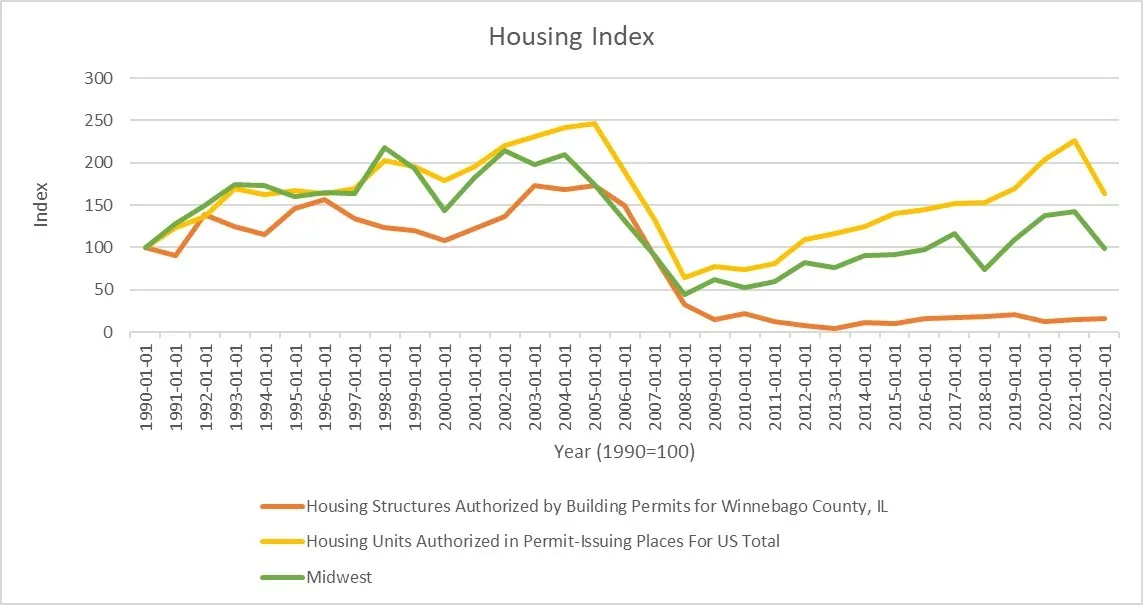

In the coming weeks, we will look at this underproduction in greater detail, specifically, what does it mean in the Midwest, Illinois, Northern Illinois, and my hometown of Rockford, IL, (see chart below), but until then I thought you may find the report interesting.

Interesting observations from the report (direct excerpts):

- Not since the beginning of suburbanization in the early 20th century have household formation patterns shifted as dramatically as they have since March 2020. Although the United States produced more housing units in 2020 than in 2019, it was insufficient to meet demand, and production was misaligned with quickly shifting preferences for where people wanted to live.

- Driven by population loss, housing availability increased 0.3% in urban America. Housing underproduction increased by 4.5% in the suburbs, spurred by high levels of household formation. Due to a sudden and dramatic drop in unit delivery, housing underproduction increased by 47.8% in small towns.

- Nationally, underproduction increased by nearly 3% to 3.9 million missing homes.

- The number of counties across the U.S. experiencing underproduction increased 32%.

Also interesting is that housing production also relies heavily on the private sector to create new units. “Many private sector leaders understand the critical intersection between a talented workforce and the availability of quality, affordable, opportunity-connected housing. Workers choose jobs based on the opportunity, location, length and mode of commute, and pay relative to the cost of living1.

What does it mean in a market where we see low supply, escalated demand, and very little production? Why aren’t developers flocking to communities to build housing? We are all reasonably well informed on interest rates and construction costs, but what else may be driving this lack of response? Admittedly, all questions we will explore in other upcoming posts, but for now, I wanted to share this hot off the press report. Please read the 2023 Housing Underproduction™ in the U.S and let me know your thoughts.

- The Role of the Private Sector in Addressing Housing Underproduction, Heather Higginbottom, 2023, https://upforgrowth.org/wp-content/uploads/2023/10/Higgenbottom-Article.pdf