Rockford – Now is the time to act!

If you have been following my Substack column, or my LinkedIn posts, you may have deduced that I am a housing advocate through and through. You may also deduce that I am a City of Rockford proponent and cheerleader.

As a Rockfordian by choice, I recognize the amazing assets we have as a community. I also recognize that we have issues to resolve for all residents to be safe and feel safe as well as have access to all quality-of-life components – regardless of address. I also recognize that for us to grow and attract world-class industries and employers, we need to be equipped to offer them (and our existing residents) an impeccable infrastructure and quality of life that both attracts and retains talent. It is for this reason I continue to write about housing issues – HOUSING IS INFRASTRUCTURE.

On Monday (12/4/23), the City of Rockford approved a $322M Capital Plan To Rebuild Rockford Streets And Other Infrastructure [Kevin Haas, Rock River Current]. The plan includes a balanced approach to ensure all quadrants of the city received investments in roadway, storm water, sidewalk, and multi-use path improvements. I applaud our city leaders for ensuring the one percent sales tax that funds these improvements will improve access to and in our neighborhoods. Thank you!

I also read Rockford has a $31M budget surplus. How should it spend it? [Jeff Kohlkey, Rockford Register Star]. This general fund surplus can go to infrastructure improvements. I am hopeful this article will influence us to think about housing as infrastructure, because what I have not read about is any good news on our housing front, beyond [dangerous] short term sale price increases. For the long game, recent headlines on housing and our housing market should trigger real concern and demand that we act.

The 20 cities with the highest property taxes in America, [Jaclyn DeJohn, Smart Asset via MSN] pegs us as having the highest property taxes in the nation – cart below. And while our median housing value has risen since the 2021 data, given the relative similar increases across all markets, we dropped consistently in the percent of property tax vs. value, but the fact remains that we are among the highest property taxes in the nation. This said, I do want all of us to recognize the years long efforts going into changing this situation. You may be interested in the Rockford Public Schools Set Property Tax Levy. Here’s What It Could Mean For Your Bill [Kevin Haas, Rock River Current] Kudos to Erhen Jarret, and his RPS205 cabinet and board for this continued fiscal diligence. Additionally, with yesterday’s City Council Capital Plan approval, Rockford City Council Comes to an Agreement on the 2024 Budget Talks [Jess Liptzin, MyStateline], agreeing to keep the City tax levy flat again – year ten as I recall. Well done Mayor McNamara, staff, and council members!

This focus on property tax is a component of the housing ecosystem that can help us truly see a citywide rebirth, but there are other factors we need to focus on too. Housing does not exist apart from neighborhood and community development and what we currently view as infrastructure – roads, etc. The real market influencers are demand and supply.

Despite our current intra-market economic conditions and indicators, demand is strong!

Supply is weak.

This weak supply is exactly why 10 Midwest Cities That Could Be Headed for a Housing Crisis, was written. The article places us third on the list of two hundred cities, for several reasons, including our low housing vacancy rate – 1.6%. While this is generally a good indicator, when reviewed with those other indicators, such as the rising mortgage delinquency rate and no new product entering our housing market, this is a recipe for disaster; in our case that disaster is elongating the lack of recovery since the 2008 housing crises. Its already been fifteen years. If we look back to my October 18, 2023 post, Rockford IL – Housing Affordability, I show that we have never recovered from 2008 and our lack of production was moving us away from being “affordable” for current and future homeowners and renters.

Other recent stories give us the tools to ignite housing production, so we do not rely solely on the downtown adaptive reuse of historic buildings for rental units. While I am a downtown advocate and developer of historic buildings, I also recognize we need multiple housing types all over our city, but the only way to make the numbers work, at present, is by leveraging those historic tax credits (45% of development costs) to cover the gap between development costs and the revenue produced from the sale or renting of housing units.

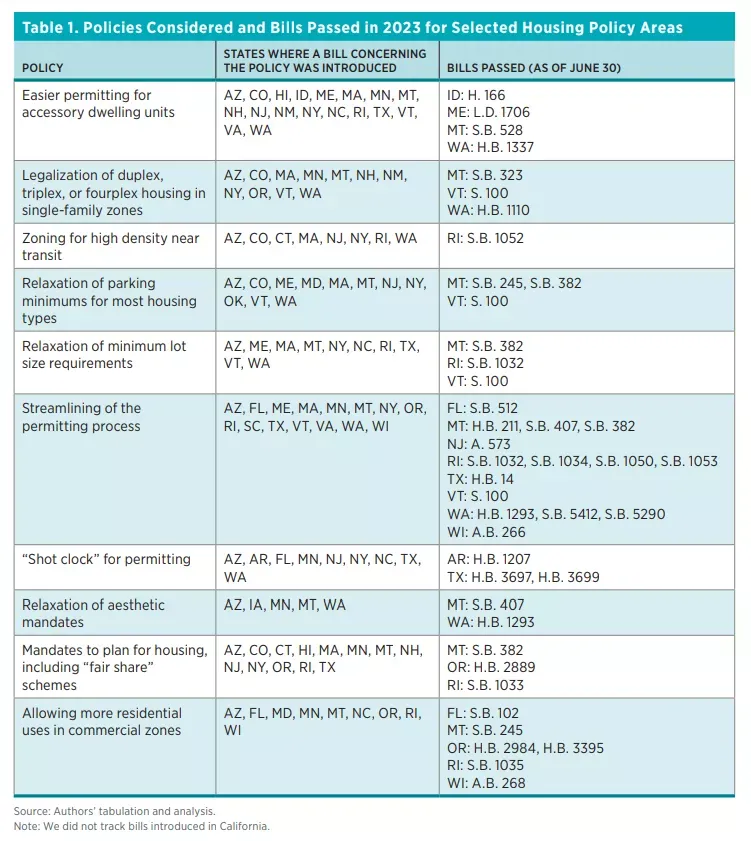

Check out Reforming Land Use Regulations and Housing Production, where I looked at potential options for Rockford to consider. If there is concern on making these changes, perhaps check out the Forbes article, Survey Finds A Large Majority Support Reforms To Boost Housing Supply, that discusses the Pew Charitable Trust Survey. The findings from one of the largest surveys done on these issues shows significant but varying support for ten policy initiatives to encourage more housing. In all cases, at least seven out of ten Americans support each policy proposal. And for those cities that have made such changes we see more stable housing prices and unlike most American cities, little to no inflation. Fortune’s, Build more houses and get rid of suburban-style zoning and inflation will disappear cites evidence for Minneapolis, MN.

As the following chart shows, Minneapolis is not alone in its efforts to address land use regulations that have stifled housing production.

Will we respond with meaningful incentives here in Rockford? If so, the time is now to address supply and be prepared for our future. You may recall the post on Labor and Housing that reminds us today’s housing challenges need to be resolved to augment and accelerate the great economic development work of our region and its leaders – the coming of 5,000 Stellantis jobs! By the numbers: The new jobs and shifts Stellantis is bringing to Belvidere, WREX.

Lastly, while I made what seems like a bold statement at the onset of this post, that HOUSING IS INFRASTRUCTURE, the reality is, that is not a bold statement. There is significant work done in both research and in execution of housing as infrastructure. Here are just a few:

- Terner Center for Housing Innovation, Addressing Housing’s Critical Role as Infrastructure.

- National League of Cities, How To Make Housing Infrastructure Resilient.

- Housing is Critical Infrastructure: Social and Economic Benefits of Building More Housing was prepared by Rosen Consulting Group for the National Association of REALTORS®

So, while we have an excess in infrastructure funding, how may we consider igniting a housing renaissance with some of these funds? By data herein and witnessing other’s successes, it looks like economic incentives to attract developers married to land use regulatory reform is our path. Will we take it? I hope so.

Many thanks to

Carlos Martinez for your research in support of this article!